By RayJaun Stelly, The Seattle Medium

The Urban League of Metropolitan Seattle (ULMS) provides multiple resources and opportunities, their mission is to empower people with programs and services designed to support and encourage self-sufficiency in all aspects of life.

ULMS serves as a liaison between community members, local businesses, and city and county government, with 80 staff members, 22 board members, and 270 volunteers they focus on six areas such as advocacy and civic engagement, education, housing, public health, and workforce development.

Of the six focal points for ULMS, homeownership is one of the most important because safe, habitable, and affordable housing is a basic need. Their housing department provides programs for individuals and families to seek knowledge, understanding, and access to pertinent homeownership education. Serving the purpose of ensuring that every community member has safe, sanitary, and permanent housing regardless of economic standing. ULMS holds homebuyer education workshops every third Saturday of the month from 10 am to 3 pm which is free and virtual, the five-hour workshop helps you meet the Washington State Housing Finance Commission’s education requirements for down payment assistance and a wide variety of affordable housing programs and opportunities for qualified applicants. The finance commission requires that all homeownership loan applicants, regardless of the type of loan, complete a five-hour housing education seminar to begin the loan process, and this workshop helps fulfill this requirement.

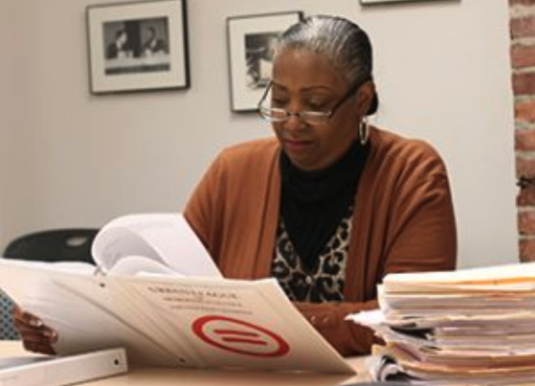

“There’s help out there, there’s a lot of help, come get yourself educated. Every third Saturday we have a session to teach you how to do things yourself,” says Linda Taylor, VP of Housing and Financial Empowerment. “We talk about how to go about filling out paperwork, it’s simple to fill out but we overthink it, everyone overthinks it.”

Those who participate will receive information on learning your options as a homebuyer, teaching about low-interest rate loans and grant programs designed for low to moderate-income borrowers, finding out about the Washington State Housing Finance Commission’s ‘house key program’ that is designed to help first-time home buyers secure a loan for the purchase.

First-time buyers will learn about low and no-down payment mortgage options, and assistance programs like House Key Plus, House Key Extra, and Home Choice and understand the actions necessary to improve their chances of mortgage loan approval. All in all, the workshop gives critical information about the key players within the home-buying process, giving an overview of the advantages and disadvantages that eventually come with the transition from being a homebuyer to a homeowner.

Taylor has been with the corporation since 1998 when she joined as a housing counselor and was responsible for pre-purchase counseling. Today, Taylor directs the housing department that has specialists who coordinate nine objectives like faith-based financial education, mortgage default that includes modifications, budget development, credit enhancement, pre-purchase education, rental assistance, transitional housing, reverse mortgage, and expungement of criminal records.

Taylor touched on the success of their workshop by saying, “the class is 100% successful and I say that because our only job is to give you information so you can make an intelligent decision on your personal home buying process for you and your family. Teaching them how to buy a house, look for financing, how to tell what the financing is, down payment assistance programs that exist, and the different kinds of insurance.”

Having extensive knowledge about the process of homebuying, Taylor has helped those who didn’t have the proper information and ultimately changed their living situation, “I’ve taken people out of homelessness because they could purchase [a home] and didn’t know that they could.”

In addition to the workshop, ULMS is looking to get more hands-on with their homebuyer/ownership help by planning to do a tour of affordable homes this upcoming summer, and a home club for people who aren’t ready to buy but want to stay on the path. Taylor elaborated further on the home club program, stating that, “they’ll look a little deep for you as far as down payment, helping people get their credit on track, go deep into your personal credit outside of the class during their one-on-one sessions. Also teaching them how to maintain and inspect the home.”

Widely understood that homeownership is a process and should start once you know it’s something you’re ready to do, it’s beneficial to weigh out the pros and cons before you decide you want to purchase a home.

ULMS provides a homeownership 101 section on their site, which gives upcoming homeowners information on the pros and cons, first-time buying mistakes to avoid and a glossary to help define the language used during the process.

ULMS empowers African Americans along with other diverse underserved communities to thrive by securing educational and economic opportunities for 93 years and counting, ULMS continues to remain committed to saving lives one family and one person at a time.

Taylor encourages people “to make sure you check your credit report and score, so that you will be in position to get lower rates to buy a house, car, insurance, or secure a better job. Reach out to Urban League Metropolitan Seattle, so you can sign up for the credit class, during that class you will receive a free credit report with a score.”